Welcome to our improved internet banking site. You'll find that link just above. If you haven't registered for internet banking yet, please contact the credit union for assistance.

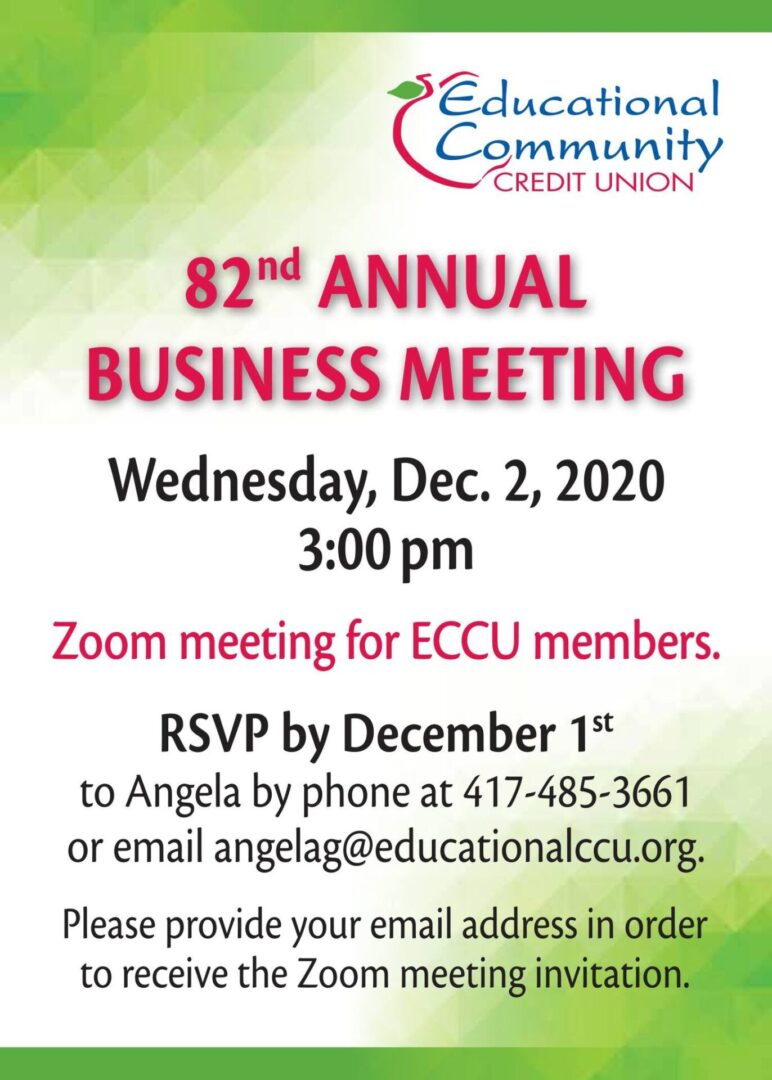

Welcome to Educational Community Credit Union

Contact us by phone to 417-831-0534 OR 417-485-3661 OR by email to financialser@educationalccu.org for additional information. It is our pleasure to assist.